Capabilities

IDENTIFY

See the total potential risk across a

loan portfolio, quantified in terms of

$ and loans

UNDERSTAND

Explore the descriptive statistics

within the portfolio to understand the

sources of risk

MITIGATE

Investigate the integrated data down

to the loan or borrower level and act

as needed

MACHINE ANALYTICS AT A GLOBAL SCALE

RMS has aggregated over 30 commercial and public data sources

into a single data asset, a Knowledge Graph. The Graph applies

sophisticated analytics to automate risk identification and speed the

process of understanding and mitigating those risks. Knowledge

Graph enables the following unique capabilities:

• 140M comprehensive business entity records and relationships

drawn from various commercial data sources

• Industry-best representation of complex ownership/partnership

structures among the businesses

• Ability to ingest your proprietary data quickly while safeguarding it effectively

• Comprehensive multi-factor risk scoring system designed by risk

experts, tunable to your organizations risk policies and appetite.

• Intuitive interactive dashboard and user graph interface that

speeds understanding and mitigation of risks

KEY SOFTWARE FEATURES

365 degree view of the customer,

company and beneficial owners

60+ risk rules and customer rating

Built-in network analysis and decision panel

Identification of shared attributes

KYC risk reporting with dashboard

solutions

Integration to be ran in line for

product adoption and risk screening

Leveraged to support credit score

to drive pricing and risk tiering of

customer

OPERATIONAL USES

Fraud and AML Screening and Alerts

Vendor Management

Risk Assessments

Loan Screening

Account Opening

Account Reviews

Fintech and Merchant Screening

CASE STUDY

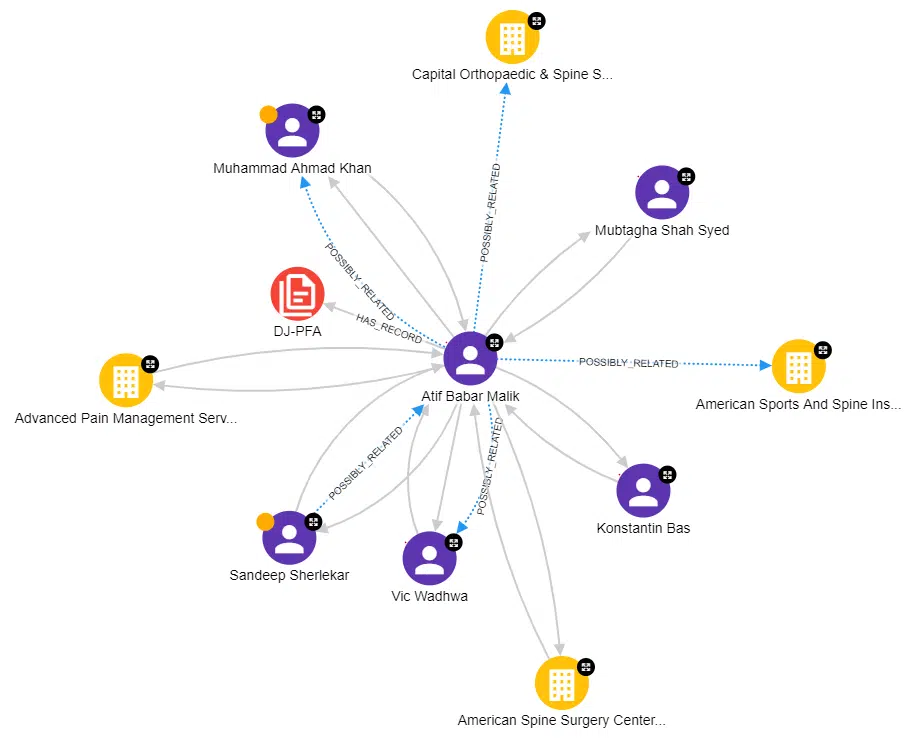

In the display below, “Advanced Pain Management Services” received a $350-$1M loan from Bank A. However, the company also appears to be on an active watchlist for fraud issues.

BENEFICIAL OWNER RESOLUTION

The benefit of RMS is the ability to connect the businesses with the beneficial owners. In this case study, the company alerted for a bad actor/owner, who is shown below. This owner flagged for:

• The entity is owned by Atif Babar Malik, who is on an Exclusion List for a multi-million dollar kickback scheme as well as tax fraud (2019) per DOJ investigation, IRS, and

HHS OIG.

• As displayed, Konstantin Bas was charged with Atif Babar Malik as an associate special interest person and a co-conspirator in the fraud scheme.

• Konstantin Bas owns another entity called ‘Accu Reference Medical Lab’ that received a $5-$10M loan from Bank B. The entity has also been used in the 2019 kickback scheme by Bas and Malik